Washington, D.C. – September 27th, U.S. Sen. Elizabeth Warren (D-MA), joined by faith leaders and community activists from around the country, spoke at a tele-town hall about the dangers of payday lending, and why we have an obligation to stop the predatory payday loan debt trap.

Payday loans are among the most deceptive and predatory forms of credit on the market. Lenders prey on vulnerable people, locating disproportionately in communities of color, and use bait and switch tactics to trick people into borrowing money at interest levels that, on average, exceed 300 percent annually. With over 12 million people taking out payday loans each year, there are millions of Americans who are stuck in the payday loan trap.

At the start of the summer, the Consumer Financial Protection Bureau proposed a new rule to regulate the predatory practices of payday lenders. An overwhelming majority of Americans agree that the predatory industry needs to be regulated and hundreds of thousands of Americans have submitted comments to the CFPB calling for a loophole-free rule. Senator Warren, faith leaders and community activists urged people to continue to submit comments until the end of the comment period, which closes on Oct. 7.

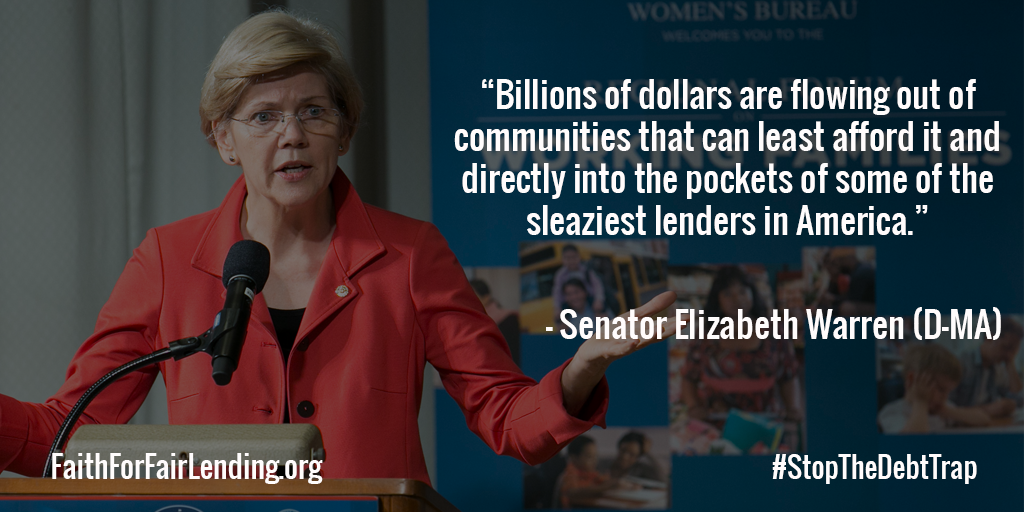

“Payday lending is an enormous problem for far too many people. Billions of dollars are flowing out of communities that can least afford it and directly into the pockets of some of the sleaziest lenders in America,” said Sen. Elizabeth Warren, senator from Massachusetts. “Faith communities around the country have played a key role in this fight. This is, at its core, a moral issue. The Consumer Financial Protection Bureau did extensive research to figure out how the payday loan business was actually operating. The rule is not perfect, but it moves us in the right direction. And it is critical that people weigh in to say that we need the strongest possible rule, and that we need it to be implemented.”

“We have to pull the veil off unscrupulous lenders so they stop preying on people in our congregations and communities to make sure the Consumer Financial Protection Bureau puts forward and enforces a strong and effective rule,” explained Rev. Dr. Cassandra Gould, executive director of PICO affiliate Missouri Faith Voices, who has been a national clergy leader in the Stop the Debt Trap coalition and has led clergy efforts to engage with CFPB Director Richard Cordray. “This is a crucial conversation with Sen. Warren about the moral urgency of ending the payday loan debt trap.”

“No family should have to go through what I had to endure as a result of being caught in the debt trap,” said Gordon Martinez, a payday loan borrower from Dallas who lost everything including his marriage as a result of being caught in the payday loan debt trap. “Now, more than ever, we need to make sure payday lenders, auto title lenders, and high cost installment lenders don’t succeed in doing more damage to families by weakening the proposed rules or undermining the CFPB’s authority and enforcement ability.”

“Exploiting the working poor with payday lending is an egregious practice that goes against God’s word to help the poor, instead putting a chokehold on some of my community’s most vulnerable families,” said Rev. Paul Slack, pastor of New Creation Church in Minneapolis, and president of ISAIAH, a coalition of 100 faith communities across Minnesota that works for racial and economic justice. “With the average borrower taking out at least 10 payday loans in succession to be able to pay off the original loan, this is not simply a financial crisis, but a moral crisis.”