Community groups call for an investigation by the Consumer Financial Protection Bureau

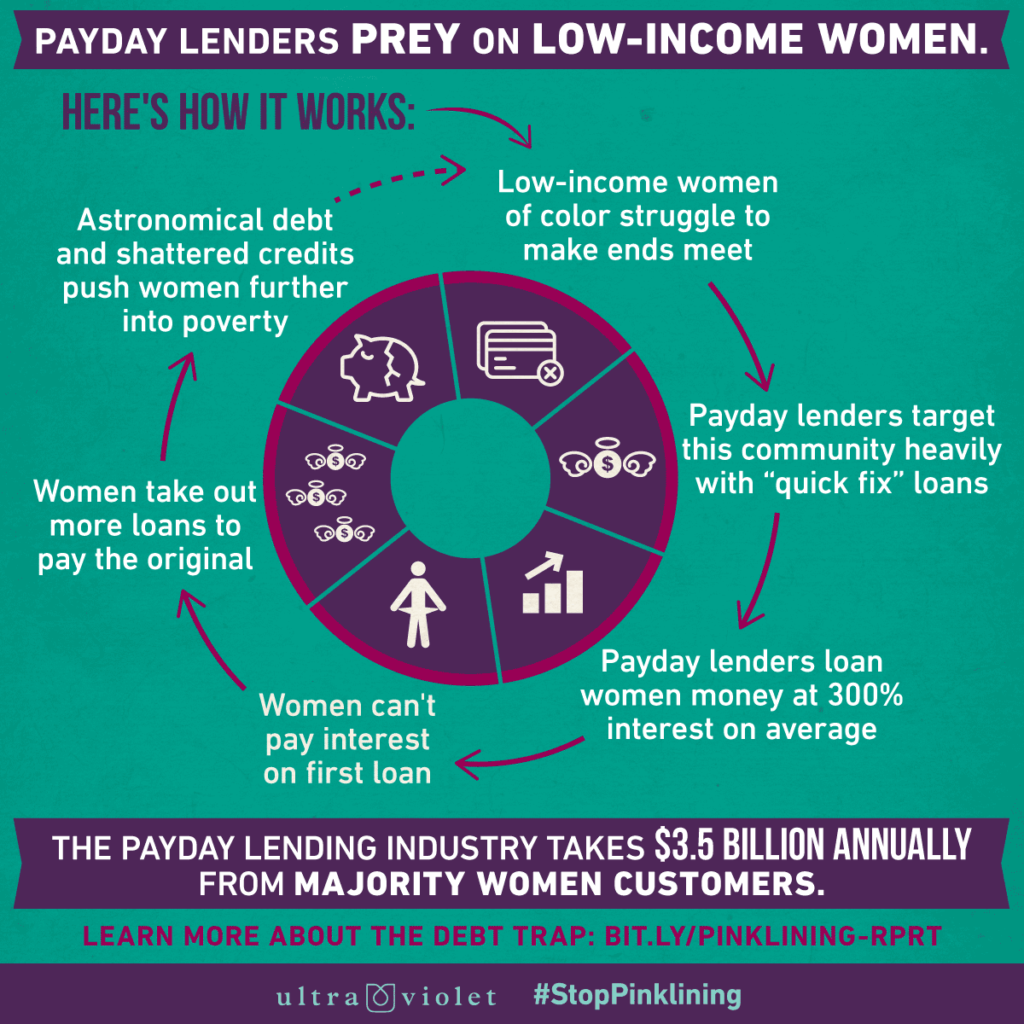

This week, three statewide community groups – ACCE (Alliance of Californians for Community Empowerment), NJCU (New Jersey Communities United) and ISAIAH in Minnesota – released a report that shows women, and particularly women of color, are being disproportionately harmed by aggressive and often predatory lending, a practice the report terms “pinklining.”

The report – Pinklining: How Wall Street’s Predatory Products Pillage Women’s Wealth, Opportunities & Futures – written by scholar Suparna Bhaskaran, shows how Wall Street and the financial sector exploit and exacerbate gendered and racialized economic vulnerability, profoundly hurting the economic, physical and emotional well-being of low- to middle-income women and women of color and their families today.

As Bhaskaran writes, “Pinklining ultimately deepens, widens and renews existing gendered and racialized economic inequality through the significant transfer of income and assets from low to moderate income women and women of color to the financial sector." The report is the culmination of a project involving 771 surveys of women about their experiences with debt and 75 additional in-depth interviews, as well as a review of existing research. The project was funded by the Women’s Equality Center.

On a national press call today releasing the report, Lorian Smith of East Orange, New Jersey, a woman featured in the report, shared her experience battling banks from foreclosing on her home. “I have played by all the rules,” Ms. Smith said. “I got an education, I held down a career for 40 years, I bought a home where I raised my family, and despite playing by the rules, I am now in a position that I am uncertain I will ever recover from. Debt has become a vicious cycle in my life and in the lives of many people I am in touch with.”

U.S. Congressmember Keith Ellison (D-MN) joined the groups on their national call today, saying, “The wealth gap between women of color and white families remains shockingly large.

This report highlights the harmful products and unfair policies that affects those with the fewest resources and calls us to take action.”

Sister Simone Campbell, the Executive Director of NETWORK Lobby for Catholic Social Justice and leader of Nuns on the Bus, also joined the national call, saying, “Predatory financial practices prey on women and people of color, thus eroding the common good. These debt traps mask the crisis of wages in our society. This must be addressed for the sake of women workers, but also for the future of our nation. Our children are the victims in the long run. For this reason, we must mend the gaps. We must have an economy that puts people, not profit, at the center.”

Lisa Donner, Executive Director of Americans for Financial Reform said, “The pinklining report underlines how gendered and racialized economic vulnerability is exploited by Wall Street. Systemic gaps in resources, opportunities and wages has generated an extraordinary transfer of wealth from women to the financial sector."

The groups are calling on the Consumer Financial Protection Bureau (CFPB) to investigate how the financial sector is targeting women and women of color through pinklining. They are also

urging the strengthening, and then adoption, of the new rules to rein in predatory payday lending issued in draft form by the CFPB on June 2 of this year.

This is part of a broader national effort to hold banks and corporations accountable for the role they play in causing and profiting off of economic inequality and austerity policies that harm working class communities across the country, particularly communities of color.