New Mexico- On April 9th, the Pit of Despair was hosted by the South West Center for Economic Integrity at the Gallup Convention Center in the city in the center of the Navajo Nation.

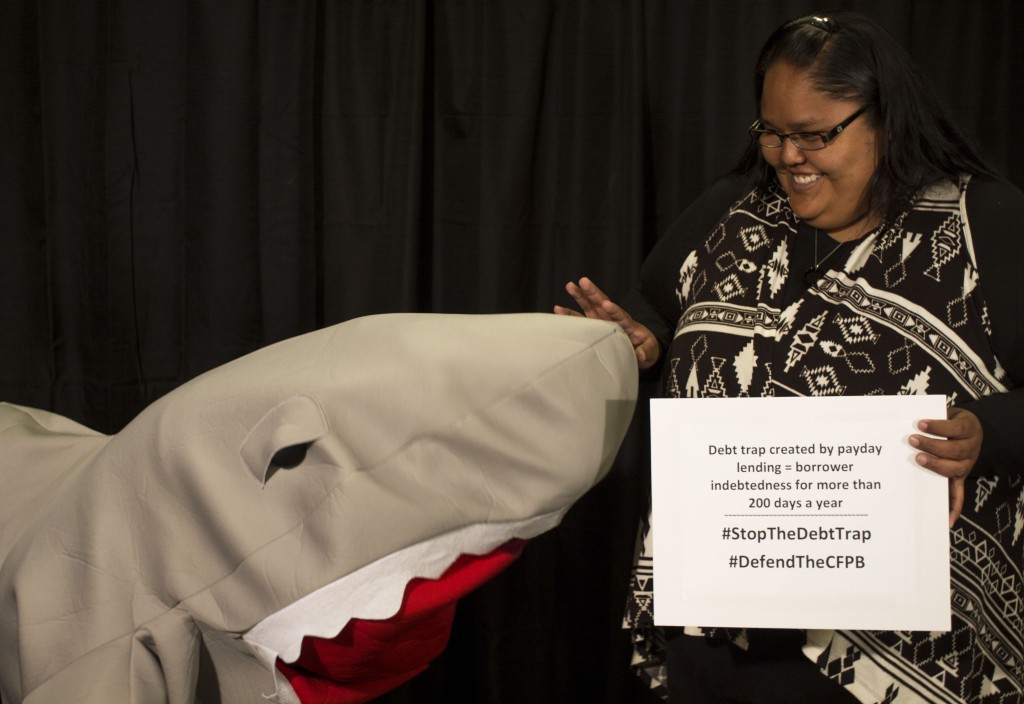

Sharkie, a predatory payday lender, found an accommodating habitat in the desert town of Gallup. How can a shark thrive in the desert? By swimming through a sea of high interest rate loans. It is no wonder then that Sharkie found time to enjoy swimming in the depths of the Pit of Despair, the art installation touring the country to help consumers visualize the debt trap they too often find themselves caught within.

Along with a photo booth and shark-themed shenanigans, the event included a workshop on how to participate in the comment period for the Consumer Financial Protection Bureau’s upcoming payday loan rule. The Be A Rule Changer website was unveiled to coincide with the event, and local press cover the big push.

Why Gallup? Payday lenders target Gallup’s low-income Navajo communities, and they have had enough of the debt trap. According to the New Mexico Fair Lending Coalition, about 40% of the borrowers who take out car title loans get their cars repossessed. Just for needing a small dollar loan, thousands of New Mexicans lose one of the biggest sources of capital they have.

That’s why organizers and Gallup residents hosted the Pit of Despair, and over seventy families came out to enjoy the festivities and learn how to fight for a strong CFPB payday lending rule.