By Huge Margins, Voters Support More Regulation to Stop the Payday Debt Trap

A used car salesman, a Wall Street banker and a payday lender walk into a bar. If the bartender is anything like most Americans, that payday lender might have a tough time getting a drink.

No One Likes Payday Lenders

Payday Lending Poll Memo June 2016

Payday Lending Topline Results – Release

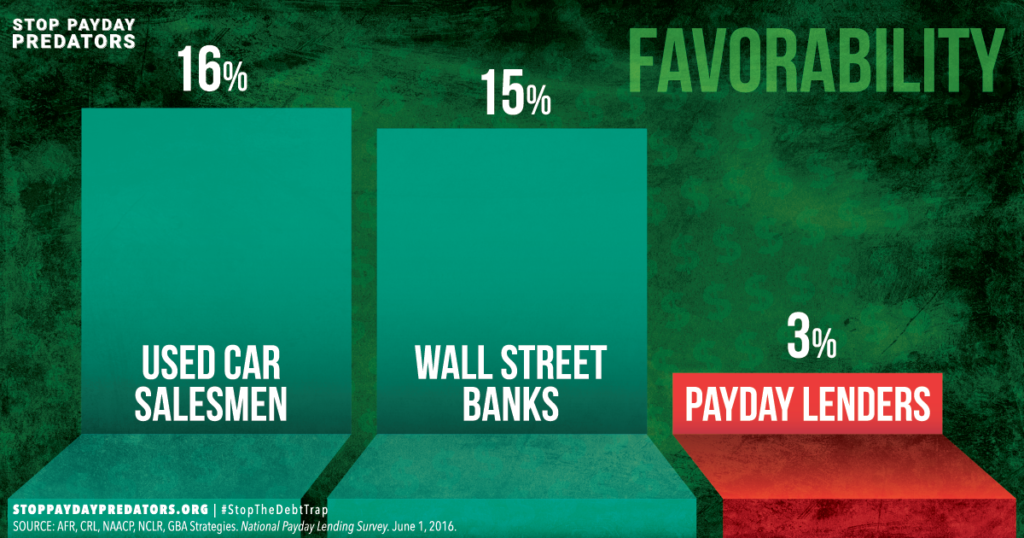

According to a new poll, conducted by GBA Strategies on behalf of Americans for Financial Reform, the Center for Responsible Lending, the National Council of La Raza, and the National Association for the Advancement of Colored People, just 3 percent of registered voters have a favorable opinion of payday lenders. Yes, even used car salesmen and Wall Street banks are more well-liked than payday lenders.

Almost no one has a favorable view of payday lenders.

The public’s disdain for payday lending shouldn’t be too surprising.

Voters Support More Regulation, in the Abstract

Given the public’s strongly negative views of payday lending, it should also come as no surprise that they think the government should do more to regulate the industry. And indeed, fully 71 percent of Americans support additional government regulation of payday lenders.

To most voters, more government regulation of payday loans is a no-brainer.

Support for more regulation of payday loans cuts across all demographic groups, geographic areas, ages, and political identifications. And three out of four people who actually have direct experience with payday loans — either because they themselves used one or a family member or close friend did — support additional regulations of the payday industry.

Voters Support More Regulation, in the Specific

Fortunately, the Consumer Financial Protection Bureau recently proposed a new rule to rein in the worst abuses of payday lending. Their proposed rule includes a requirement that lenders verify, before issuing a new loan, that borrowers have the ability to repay the loan. The rule also limits how many loans a lender can issue to the same borrower in quick succession. According to the new poll, after hearing about the specifics of the proposed rule, support from voters remained extremely strong (it even increased a tiny bit). Overall, 73 percent of registered voters support the CFPB’s proposed rule on payday lending.

Support for reining in payday lenders cuts across party lines.

Support for the CFPB’s rule was nearly uniform across party identification with support from 76 percent of Democrats, 75 percent of Republicans, and 71 percent of Independents. This is certainly one issue on which Americans of all political stripes can agree.

Scam, Trap, Loan Sharks: How Americans View Payday Loans

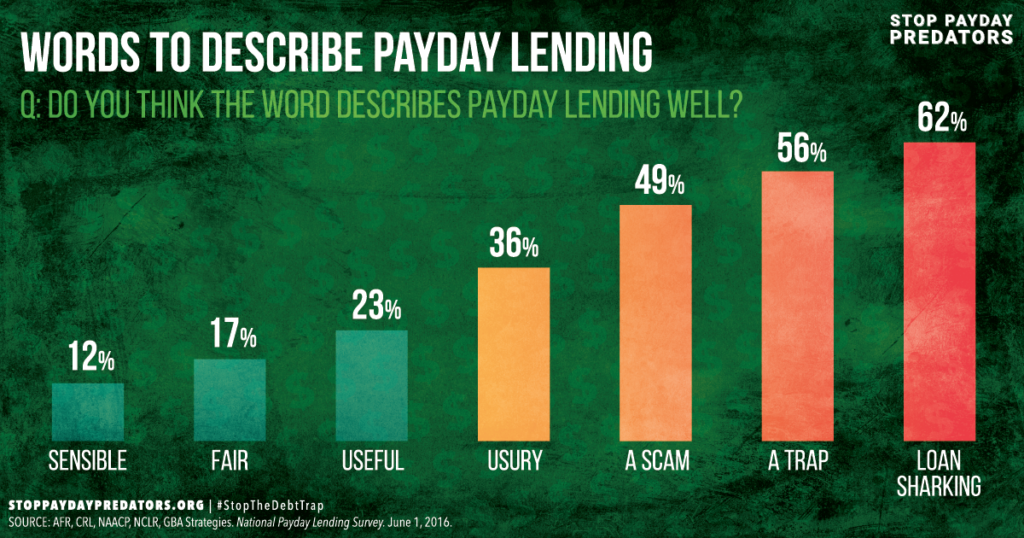

Why are Americans, regardless of political persuasion, so strongly in favor of reining in payday lending? One set of questions in the poll goes a long way toward answering that question. The poll gave respondents a series of words or phrases that might be used to describe payday lending. Some of these words were positive, like “sensible” or “useful.” Others were negative, like, “scam” or “trap.” Respondents were then asked if they thought each word or phrase described payday lending well. The responses were revealing.

American voters think payday lenders are almost indistinguishable from loan sharks.

Only 23 percent of voters thought the word “useful” described payday lending well, compared to 56 percent who thought “a trap” described payday lending well. The phrase that most Americans thought described payday lending well? Loan sharking. 62 percent of voters thought “loan sharking” was a phrase that described payday lending well. No wonder Americans support more regulations.

Communities of Color Strongly Favor Reining in Payday Lenders

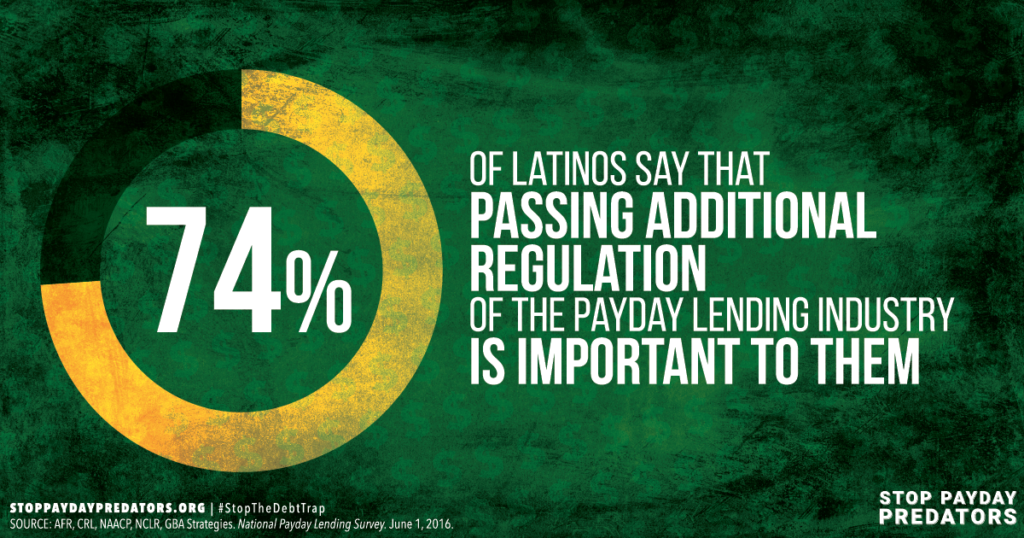

The new poll also includes over-samples of African American and Latino voters. Payday lenders tend to deliberately target communities of color, regardless of income, and as a result, people of color are much more likely to have direct experiences with payday loans. And the poll reveals that African American and Latino voters are even more strongly in favor of reining in the payday lenders than white voters. For example, 74 percent of Latino voters say that passing additional regulation of the payday lending industry is important to them, compared to 68 percent of white voters who say the same. And 78 percent of African Americans support additional regulations of payday lenders, compared to 70 percent of white voters. But regardless of race, most Americans want to see the government do more to stop the abuses of payday lending.

Voters of color are especially likely to support payday loan regulations. Maybe that’s because the payday industry deliberately targets them.

The Facts Make Voters Even More Inclined to Regulate

Fortunately, the more voters learn about payday lending, the more likely they are to support strong regulations. The poll included several facts about payday lending, including some that the payday lenders themselves like to tout. The poll then asked respondents if learning each fact made them more or less likely to support regulating payday loans. Every single fact — even ones that supposedly favor payday lenders — resulted in more support for regulating payday lending. Every single one.

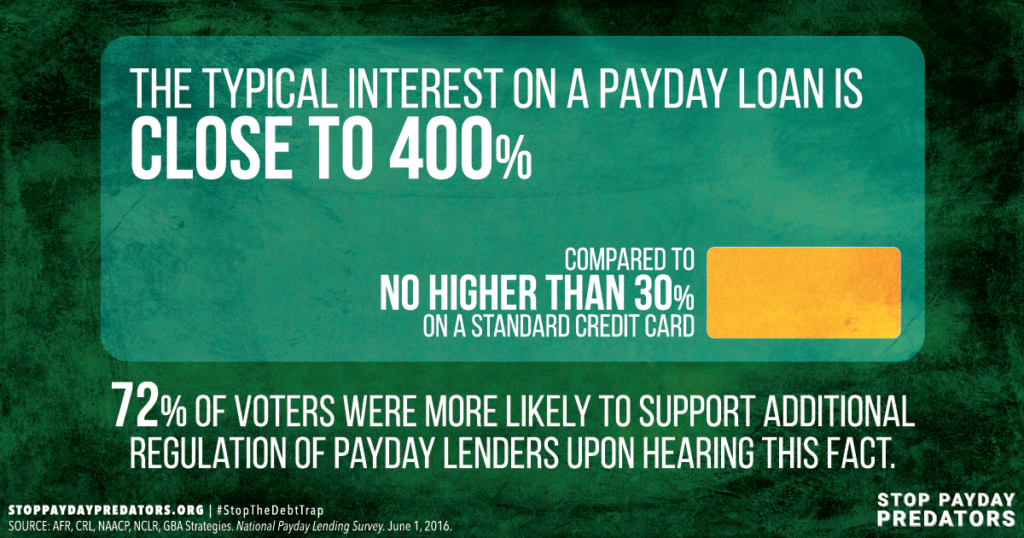

Learning new facts about payday loans results in even more support for regulation.

For example, upon hearing that the typical interest rate on a payday loan is close to 400 percent, compared to no more than 30 percent on a credit card, fully 72 percent of all voters said that fact made them more likely to support regulations on payday lenders. The poll even presented as a fact the claim that, without payday loans, many borrowers would be unable to cover basic expenses. This “fact” made 40 percent of voters less likely to support regulations, but it also made 51 percent of voters more likely to support regulations!

The bottom line is that American voters dislike payday lenders, think that payday lending is a scam, and think that it has more in common with loan sharking than it does with ordinary forms of credit. Voters of all backgrounds and political stripes support the idea of additional payday lending regulation, and they support the specific regulations proposed by the Consumer Financial Protection Bureau. Voters of color are especially likely to support the rule to rein in predatory payday lending. And the more voters learn about payday lending, the less they like it.

Your voice matters

If you count yourself among the more than 70 percent of Americans who agree that we need strong rules to stop the debt trap of payday lending, you have a unique opportunity to make your voice heard. The Consumer Financial Protection Bureau is accepting public comments on its proposed payday rule for the next several weeks. This comment period is an important time for the American public to make its views known. You can submit a comment in support of a strong rule by going to StopPaydayPredators.org today.